Why life insurance?

When a family loses a loved one, nothing can replace them.

But life insurance ensures your family are supported financially if the unthinkable happens.

That's ok too!

It's yours when you protect your family today

Why type when you can talk?

The fastest way is to call direct.

Free plushie and vouchers when you call direct.

No credit card required Free & fast quote

When a family loses a loved one, nothing can replace them.

But life insurance ensures your family are supported financially if the unthinkable happens.

We'll help you to plan your cover, so you can take a load off your mind.

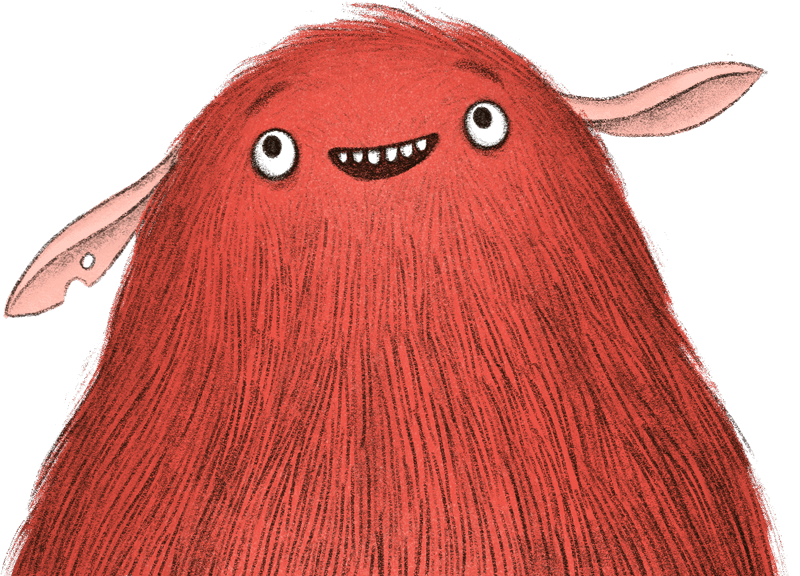

With Red Duo you can get extra rewards when two people get covered at the same time.

Red Rewards are a way for us to say thank you to our new customers.

For every new policy, we offer a choice of welcome gifts. You can choose your gift when you take out insurance, and you will receive it after six months with us.

Red Monster Plushies are posted as soon as your cover is activated!

At Red you can choose cover where your price will stay the same throughout the term of your policy.

We can also offer index linked cover that rises with inflation. Your premiums may increase with index linked cover.

Speak to us today to find out what’s best for you and your family.

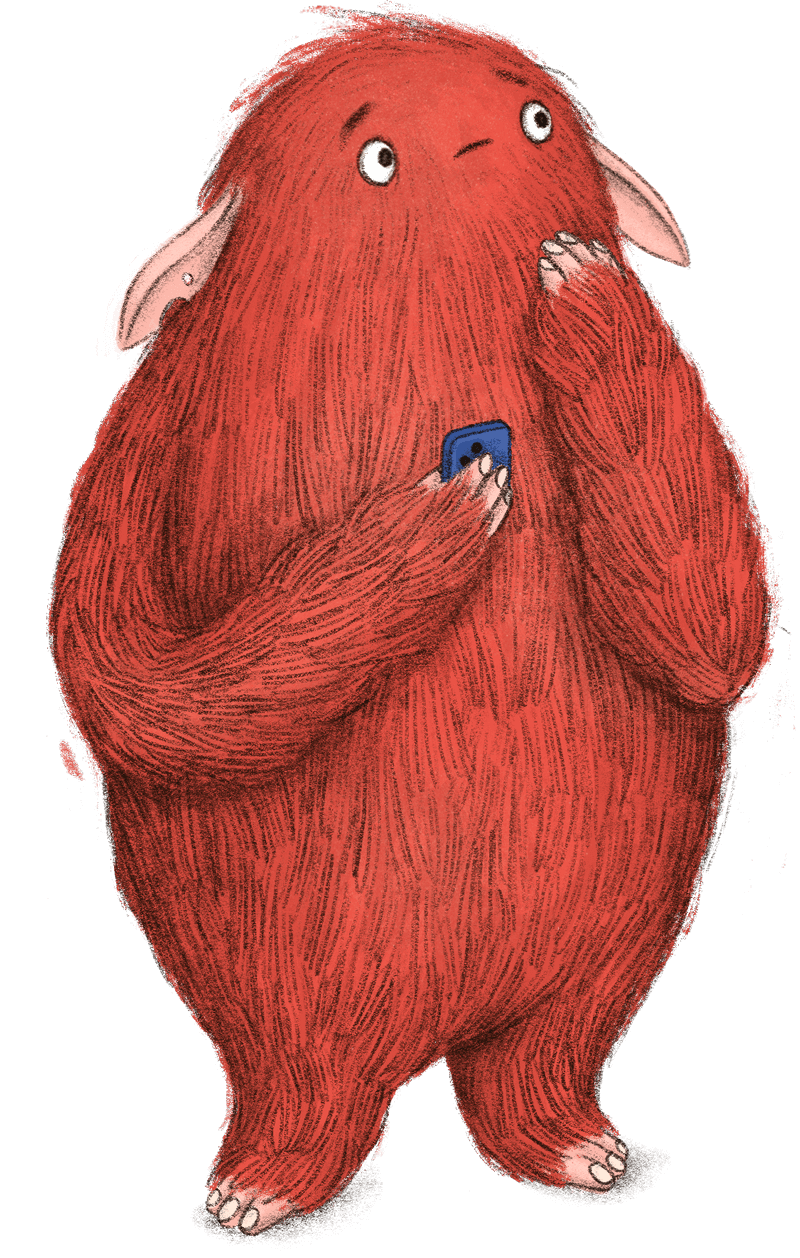

See why other parents chose Red Life Insurance to protect their families.

Sounds great, let’s go!

For every new policy we donate £1 to Childhood Bereavement Network. Registered charity No. 258825.

Speak to us today about how terminal illness cover can help support your family.

We know that money can't replace a loved one. But if the worst should happen to you, life insurance pays out a lump sum to your family. This can help them cover bills and carry on living their life as normally as possible.

Financial support can make the world of difference at a difficult time. If your household relies on two incomes, life insurance is a smart choice.

It's free to get a quote with Red. The price we give you on the phone is what you'll pay for the rest of your insurance term – no expensive surprises around the corner.

How much you pay for your insurance will vary depending on a few factors like your age, and if you smoke or not. We make sure to benchmark our rates against the UK's biggest insurers so you can rest assured that you're not paying above the odds.

At Red, we pay out 100% of legitimate claims. When we set up your policy, we help you choose the length of your insurance and the amount that you want to get.

The only reason your policy wouldn't pay out is if if you aren't truthful on your application, engage in risky behaviour, or have unpaid monthly fees.

Smoking and using tobacco products is linked to a higher chance of disease and death. Even if you don’t smoke or vape regularly, it’s important that you tell us. If an application isn’t honest, it can mean that the insurance is invalid and won’t pay out.

Tobacco products include quitting aids like gum or patches, as well as cigarettes and vapes (or e-cigarettes). If you’ve used anything that contains any tobacco, it’s best to let us know.

Life insurance is a bit more complex than other insurance policies, and often deals with very high pay out amounts. With Red’s experts on the line, we can find a policy that fits your unique needs quickly, and you can skip the time-consuming online forms.

Let's get a quote in 3 ...